Photo By Real Vision

Considering the level of adoption, the likelihood of success is in your favour.

Raoul Pal has a broad and deep understanding of financial markets.

He’s often called the leading Business Cycle Economist and Economic Historian.

The Economic Historian part is down to his ability to break down complex ideas and uses clever historical references to describe what may happen in financial markets.

He’s eerily accurate (most of the time) and easily explains his points so the person on the street can understand.

It’s also no secret that Raoul Pal is a Cryptocurrency maximalist and maintains a positive outlook on the industry despite the unprecedented panic cycle it was experiencing. He emphasises while negative sentiment is at an all-time high, the fundamentals and potential of blockchain technology remain intact.

Banking failures and economic turmoil could create an ideal environment for the cryptocurrency industry to thrive.

Pal thinks being open-minded to Crypto and not being tribal about your choice will help you exploit the potential demand.

The entire Crypto space can increase by 200x from here, and it’s something you’ve never seen before because nothing like this has ever happened in human history in such a short time.

But wait, there’s more.

Buckle up, strap yourself in and let’s get into it.

Crypto Is Growing at Such a Rapid Pace It’s Expected To Reach a Billion People by the End of 2024.

Pal is joking that even a 3-year-old could choose a promising cryptocurrency. What he’s saying is you might be making things more complicated than they need to be.

Given the potential for massive adoption and explosive growth, Raoul says you getting some exposure to cryptocurrencies is a no-brainer.

The number of global internet users who own cryptocurrency is significant — with over 10% of users holding some form of digital currency. The number is only increasing.

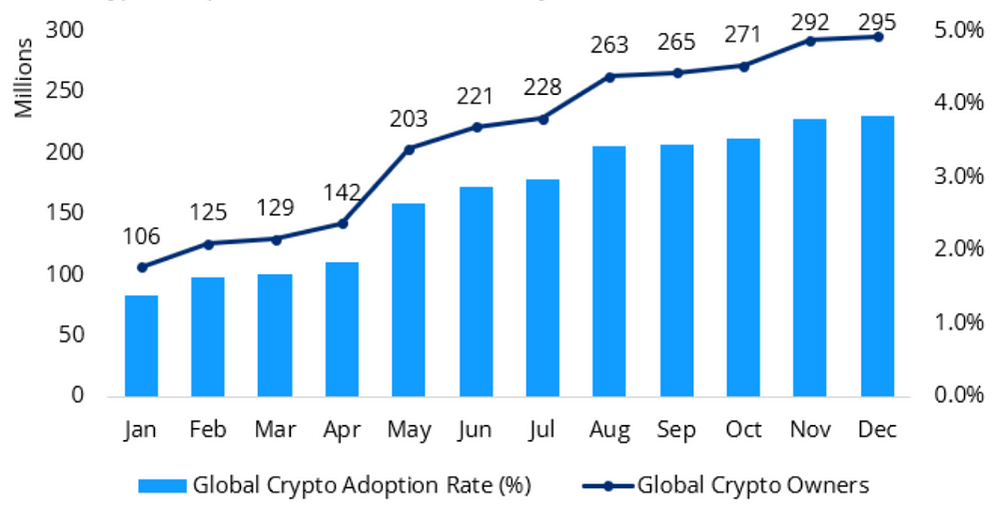

This is approximately 500 million people, based on 5 billion internet users worldwide. Recent estimates from Crypto.com suggest an even higher number of 300 million crypto owners globally, a remarkable 275% increase from their figures in January 2021.

These numbers are staggering and indicate cryptocurrency’s growing interest and adoption globally.

Even with a slight decrease in growth rate, cryptocurrency adoption is still significantly outpacing the internet’s peak growth rate.

As a result, it’s projected by 2030, or perhaps even earlier, there will be approximately 4 billion cryptocurrency users, presenting tremendous potential for price increases.

Raoul Pal — Source

“If you look at the rate of adoption that’s going on in the entire crypto space, and this is my true north, this is all I need to know.

There’s one single thing I need to know and nothing else. Crypto is growing by 113% a year (on average) in the number of users.

We will assume that over time the Trend rate of growth Falls a bit, so if it falls from this year and goes down to 83%, that’s a significant fall in the growth rate.

We saw the internet do similar, but its Peak growth was 63%. We’re now 113%.

At this rate, it will reach a billion people by the end of 2024, bringing us to about three or four billion people by 2027–28. Okay, so a blind chimp can choose a cryptocurrency and get rich.”

To Fully Grasp the Magnitude of This Opportunity, It’s Crucial To Understand Its Scale — Nothing Short of Enormous.

Pal’s unwavering confidence in the cryptocurrency industry is evident from his statement that finding an asset offering a 100x multiplier is highly improbable, especially one like Bitcoin, which has already seen a 2 million per cent increase.

And then for it to still have wiggle room to increase exponentially is insane.

Demand for cryptocurrency assets will surpass supply, implying nearly every cryptocurrency asset has the potential to increase in value.

Raoul Pal — Source

“If you look at the size of the assets, the entire crypto space as of today hit 2 trillion again.

Global equities are about 200 trillion. International bonds are about 200 trillion global real estate’s about 100 trillion.

Two trillion to 200 trillion, that’s probably 100x, and we all know almost all of us to realise all bonds, securities, and assets are going on chain anyway.

Hence, it’s even bigger than that.

Don’t Overthink It. It’s Harder To Make the Wrong Decision.

According to Pal, adopting a broader perspective of the cryptocurrency industry eliminates tribalism and fear of making wrong decisions. This alleviates pressure, allowing you to make basic bets with confidence.

Raoul Pal — Source

“Take the pressure off, make some basic bets, you know, Bitcoin, Ethereum, a couple of others here and there, and then you can just have a basket of stuff and over time decide, okay, I quite like that or that’s getting faster adoption, suddenly you start to look at things like Solana which is getting adoption, it’s happening, and it’s clearly happening in the price. Okay, do you want to own more of that, maybe?

Is Polkadot not getting to where it should be? I don’t know yet, but it’s worth watching.

Now there’s a lot of stuff, and that’s how I tend to deal with it: forget trying to model it and look for fair values.

As I said, you can be a three-year-old kid and be given a box of names of cryptocurrencies and take ten out. You will literally make 30 times your money over the next 20 years.”

Final Thoughts

Raoul Pal’s statement that the rising demand for cryptocurrency will benefit all digital assets is accurate.

While some cryptocurrencies may experience exponential increases in value, others may become worthless.

As a professional investor, Pal deploys significant capital and conducts extensive research to support investment decisions, a luxury not everyone has.

Nonetheless, his point remains valid.

With cryptocurrency growing at 113% annually, the safest play is to Dollar Cost Average into Bitcoin and Ethereum and invest with a long-term horizon.

And considering the current level of adoption — the odds of success are in your favour.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.