Source Wiki Media Image

Once you save, you experience something different with your money to the person who spends it immediately.

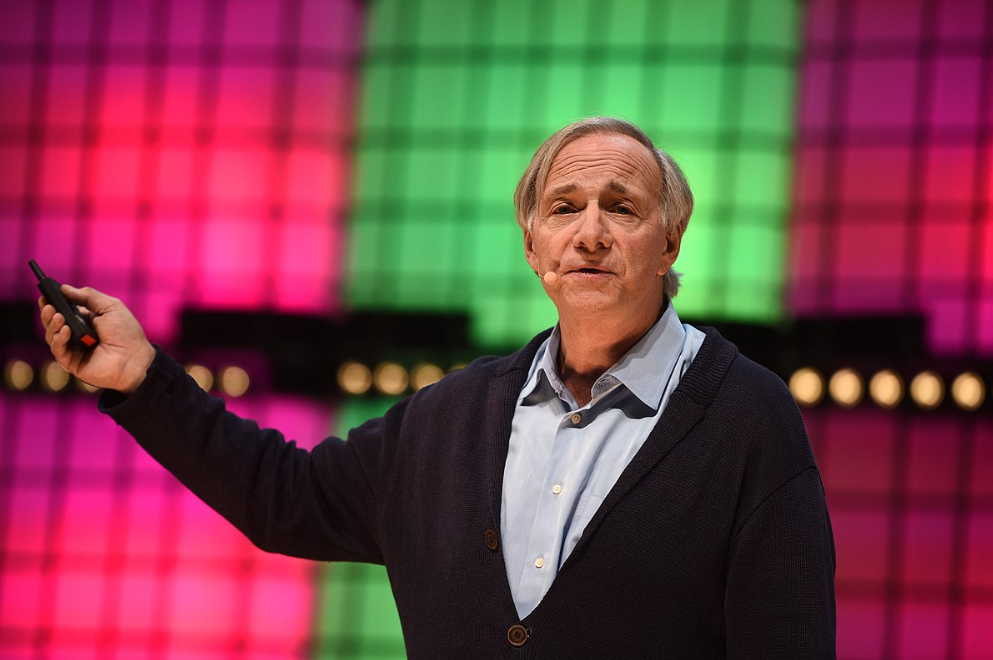

After getting rowdy at a Christmas party, Ray Dalio punched his boss in the face.

As a result, he started the World’s Largest Hedge Fund.

Now he’s considered one of the best investors of all time.

Dalio is a sharp intellect.

And a billionaire who amassed his wealth by being a deep thinker and a brilliant communicator.

Recently in a video on his Instagram page, he quoted the Stanford Marshmallow Experiment conducted by Walter Mischel.

In the Marshmallow Experiment on delayed gratification, a researcher offers a child a choice between a small but immediate reward or two rewards if they waited for a while.

During this time, the researcher left the room for about 15 minutes and then returned. The reward was a marshmallow or pretzel stick, depending on the child’s preference.

In follow-up studies, the researchers found that children who could delay their gratification and wait for the second marshmallow had higher SAT scores, were less likely to abuse substances, had a lower likelihood of becoming obese, had better responses to stress, were reported to have better social skills by their parents, and generally scored better in a range of other life measures.

Dalio related this study to your finances and said that when two people have the same opportunities, the one who can delay gratification and not spend their money immediately is more likely to become wealthy.

By counting how long you can live without spending, you can develop the discipline to save and grow money.

Saving your money means you’re delaying instant gratification.

According to Dalio, after saving, the next step is to decide where to hold and keep it. Once you save, you experience something different with your money to the person who spends it immediately.

There are counterarguments that the Sanford Marshmallow study may not necessarily measure self-control or willpower but rather the child’s trust in the experimenter and the reliability of the situation.

Regardless, Dalio is confident that the underlying message of delaying gratification with your finances will benefit you in the long run.

Ray Dalio — Source

“Like the marshmallow test, you must delay gratification with your finances.

When you save, the next natural question you ask yourself is, where should I hold, and where should I keep this money?

When it comes to money, and you don’t spend it for instant gratification, it means you’ve got savings.

The next thing that comes at you is, what do I do with my savings?

Now you experience something different with the money you have, compared to the person who spends it straight away”.

You could argue that a test conducted on children in 1970 may not apply to today’s wealth status.

Let’s dig deeper into this idea.

While you must challenge information found online, it’s worth considering whether delaying gratification works in all areas.

Exercising self-control may be more challenging for those with fewer resources or opportunities. For example, the child in the marshmallow test may have been hungry, distrusted the researcher, or come from a culture that values instant gratification.

While it’s true some people may have a more challenging time delaying gratification, especially when facing immediate needs, Ray Dalio argues that it’s crucial to have self-control with money and resist the temptation for short-term pleasure.

By deferring immediate rewards and saving money instead of spending it immediately, you can improve your financial situation over time and create opportunities you may not have had otherwise.

Ray Dalio — Source

“I want to distinguish that there’s a big difference in people’s opportunities worldwide, but if you compare two people with equal opportunities. When it comes to money, it’s delayed gratification that separates them.

Once you realise that deferred gratification will improve you, you begin to count and say how many days, months, weeks, or years can I live if I don’t spend the money I have coming in”.

Americans Are Saving Less Than Ever Before: What This Means for Your Finances

I agree with Dalio’s view on saving and delayed gratification regarding money.

In America, the savings rate is at an all-time low, which could have severe consequences for individuals and the broader economy.

According to the Bureau of Economic Analysis, the savings rate in the United States has been steadily declining over the past few years. In 2019, the personal savings rate was 7.6%, much lower than the 11% savings rate in the 1980s (Current savings rate 4.7%).

At the same time, consumer spending has been on the rise, fuelled by easy access to credit and a culture that values instant gratification over saving for the future. Consumer spending has doubled since 2009 from $700 Billion to $1.4 Trillion in 2023.

It’s a particularly concerning trend because people spend more, borrow more, and save less. Savings are the key to investment, and investment drives economic growth.

As Dalio explains, when people save money, they can invest in businesses, real estate, and other assets that create jobs and generate wealth. Without savings, less money is available for investment, leading to slower economic growth and, ultimately, recession.

The personal saving rate as of publishing is 4.7%, right about where it was before the 2008 housing crash.

Dalio says you should consider savings as freedom and security. And tally up how many months you could survive on your current level of savings.

The best way to approach this is by calculating your monthly expenses and the amount you saved.

This way, you can determine how many months you can go without an income and value your savings accordingly.

Ray Dalio — Source

“Think about your savings and how much money you have saved. The best way to do this is to calculate how much money you spend each month and how much you have saved.

This will help you determine how many months you can survive without an income.

It’s important to value your savings and calculate them because savings provide freedom and security. Take some time to reflect on what this means for you.”

Your Environment Impacts Your Ability To Delay Gratification.

In an attempt to repeat the marshmallow test, researchers at the University of Rochester conducted a similar experiment with a slight change.

The researchers divided the children into two groups before giving them a marshmallow. The first group received a set of unreliable experiences, such as being promised a bigger box of crayons or better stickers but never receiving them.

In contrast, the second group had reliable experiences where they were given what they were promised. The impact of these experiences was significant.

Children in the unreliable group had no reason to trust that the researchers would give them a second marshmallow, so they didn’t wait long to eat the first one.

The children in the second group had a positive experience that helped them see delayed gratification positively. The researchers promised better crayons and stickers and then delivered on their promises.

It allowed the children to register that waiting for gratification was worth it and that they had the capability to be patient. Consequently, the second group waited an average of four times longer than the first group.

The child’s ability to delay gratification and show self-control was not predetermined but instead influenced by the experiences and environment surrounding them.

Even a few minutes of reliable or unreliable experiences were enough to push the child’s actions in one direction or another.

Just like how unreliable experiences impacted the kids in the marshmallow test, adults living in certain parts of the world might have unpredictable experiences based on where they live and where they keep their money.

Poor financial tools, unreliable social security and retirement benefits remove large portions of society from the financial system and understandably leave some scratching their heads at Ray Dalio’s views.

Dalio does preface his thoughts by saying they apply to people with equal economic opportunities.

Final Thoughts

The Stanford marshmallow experiment is one narrow data point with many aspects you could interpret differently.

Ultimately it highlights the importance of delayed gratification for long-term success.

I believe Dalio is right.

In terms of your finances, if you can resist the urge to spend impulsively and instead save, you’ll consider what to do with your money and have a different conversation with yourself, which could make you better off financially.

It’s obvious.

But I appreciate people have different economic opportunities everywhere in the world, as the second experiment highlights that your environment dramatically impacts your outcomes.

Walter Mischel, who conducted the original Marshmallow experiment, has been studying for 50 years how children develop self-control and what the implications of self-control are for their lives as they grow up.

He says the test results have significant connections to how their lives work. Children who self-regulate have a much better chance of doing well in school and thriving as adolescents.

Mischel says the good news is willpower and self-control are teachable to children and adults.

He makes the perfect point about delayed gratification.

Walter Mischel — Source

“Self-control, which used to be called willpower, is obviously important. It’s been an issue for us ever since Adam and Eve lost paradise because they couldn’t resist the temptation of the serpent and the apple.”

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.