The Government is lying to you about how bad things are. If we’re getting off with a recession, we’re getting off easy

Peter Schiff is an American Stockbroker

He’s made a name for himself predicting the 2008 Financial Crisis

He’s now a Financial commentator.

And radio personality.

Schiff talks a lot about money and how it works. He thinks the people who control the United States money (Fed) must do a better job. He also thinks returning to the gold standard would be better than anything we do now.

Peter Schiff receives criticism for his tendency to be overly pessimistic, making dire predictions about the economy’s future.

Die-hard supporters of Schiff often say global events confirm his predictions, and he’s simply trying to sound a warning about the risks of a fragile financial system.

Recently, CEOs of big companies like Facebook, Alphabet, Microsoft, and Goldman Sachs are cutting thousands of jobs because they fear a significant recession is coming.

Schiff says their actions tell us what’s on the horizon, and, strangely, the Biden administration ignores all the evidence indicating a recession.

The current Government think the economy is doing ok based on unemployment figures. But Schiff says the dollar is heading towards disaster, and if we get off with a recession, we’re getting off easy.

Try a depression—the likes of which we’ve never seen before since the 1930s.

After ten years of interest rates at 0 per cent, he says there’s no prayer we’ll get away with a soft landing here.

You know what to do, buckle up, strap yourself in and let’s get into it because this gets good.

We’re Heading for a Crisis Far Worse Than Anything We Saw in 2008

The economy isn’t doing well despite low unemployment rates.

The Bureau of Labour Statistics released a report in March 2023 showing that nonfarm payroll employment rose by 236,000 and the unemployment rate in the United States edged to 3.5 per cent in March 2023, against expectations that it would hold at 3.6 per cent. The unemployed decreased by 97 thousand to 5.8 million, and employment levels rose by 577 thousand to 160.892 million.

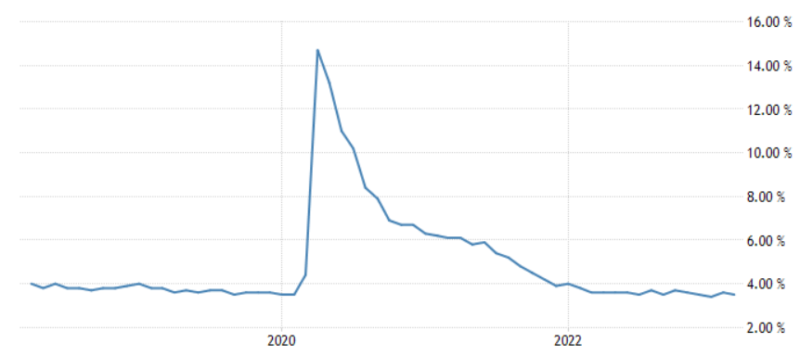

The massive spike on the chart below reflected the Covid lockdowns when people were experiencing mass layoffs and the world shut down. Unemployment went to just under 15%.

Even though the report shows employment continued to increase in leisure, hospitality, Government, professional, business services, and health care, Schiff says many of these jobs are low-paying and part-time, resulting in people working 2nd and 3rd jobs to make ends meet.

Peter Schiff – Source

“We are in the early stages of another financial crisis that nobody wants to acknowledge, but that’s exactly what’s happening here.

This financial crisis will be far worse than the one we had in 2008 because we have a much bigger problem today than before.

The consequence is a much larger financial crisis now than the one we had then. It will end with an all-out U.S. dollar currency and sovereign debt crisis, and inflation will explode through the roof.”

1929 Was a Far Worse Crisis Than Any That Could Occur Today.

The Great Depression was an awful time for the United States. It started as a regular recession in the summer of 1929, but things worsened later that year and continued until 1939.

During this time, the number of goods made decreased significantly, and prices fell dramatically.

Industrial production in the United States dropped 47%, and real gross domestic product (GDP) dropped 30%

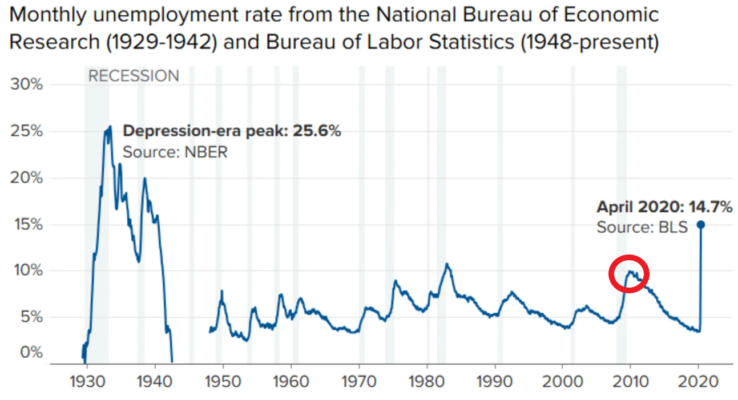

The unemployment rate was also high. Data shows it was up over 25% at its worst during the Great Depression. As of publishing, unemployment is 3.5%.

Comparing the Great Depression to the Great Recession of 2007-09, America’s next worst recession, it’s clear how severe 1929 was.

During the 07-09 Recession, the country’s GDP decreased by 4.3%, and the highest unemployment rate was around 10%, still well below the 25% of the Great Depression.

Circled in red is the 2008 financial crisis.

It’s All Very Well Accessing Your Money Out of the Bank, but It Won’t Be Worth Much When You Do.

Peter Schiff says we can’t avoid suffering the consequences of failed policies that have gone on for decades.

He thinks that banks as businesses have failed but will never be allowed to go out of business because the Government will continue to bail them out instead of letting them die and wash out the system.

It results in you being able to get your money out of the ATM, but it stings everybody because the dollar’s overall value plummets.

Peter Schiff – Source

“If the Government and the FED allowed it to happen, many banks would fail, but unfortunately, they won’t let them fail.

They’re going to print a bunch of money and create inflation instead. So, instead of losing your money at the bank because it fails, your bank won’t fail, but your money at the bank will lose its Value.

You can go to the bank and take out your money, but when you go to the grocery store or the gas station, you won’t be able to buy much.”

It’s a Recession Which Will Likely Be an Unavoidable Depression.

Schiff thinks the real threat to the economy is the possibility of foreign countries no longer accepting the U.S. dollar as a form of payment for the products they sell.

The U.S. currently has a significant trade deficit, meaning it imports more goods than it exports. It’s only possible because foreign countries are willing to accept U.S. currency in exchange for the goods they produce.

If foreign countries stop accepting U.S. dollars, it wouldn’t be good for the U.S. economy. The U.S. couldn’t buy things from other countries and would have to make things themselves because they don’t have the manufacturing capacity.

Peter Schiff – Source

“I think we’re probably already in a depression. We’d be fortunate to escape with just a recession.

It’s just going to get worse. One of the reasons why the jobs report wasn’t much worse, as far as the numbers are concerned, is because the Government created something like 50,000 jobs.

Somehow, the economy is more robust because, based on a number, we’ve got more jobs. But the quality of those jobs has decreased, and most people with two or three lousy jobs would rather have one good-paying job. Unfortunately, they no longer have that option.

The real threat will be the foreigners pulling the rug from under our economy by abandoning the dollar.

That’s what makes this dysfunctional economy possible. We have a trillion-dollar trade deficit, meaning we import a trillion dollars worth of stuff we didn’t make.

We can only do that because foreigners take the paper we print in exchange for everything they produce. But if they stop accepting our currency, how will our economy function without all this stuff?

We certainly don’t have the factories to produce it.”

Final Thoughts

Peter Schiff is correct in what he says. We’re heading towards something unavoidable.

Don’t pee on my leg and tell me it’s raining.

There is no comparison between how bad things were during the Great Depression and how good our lives are today.

Each downturn we’ve experienced, he’s sounded the same alarm. A bit like he did in 2008.

Peter Schiff 2008:

“This is not just a recession. This is a depression. We are in a depression right now, and it’s going to get worse.”

While the economy isn’t in a good spot, public commentators with doomsday mentalities scare the sh*t out of you if you listen to them long enough.

Sometimes it’s better to switch off the TV.

It’s a recession.

We’ll be fine.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.