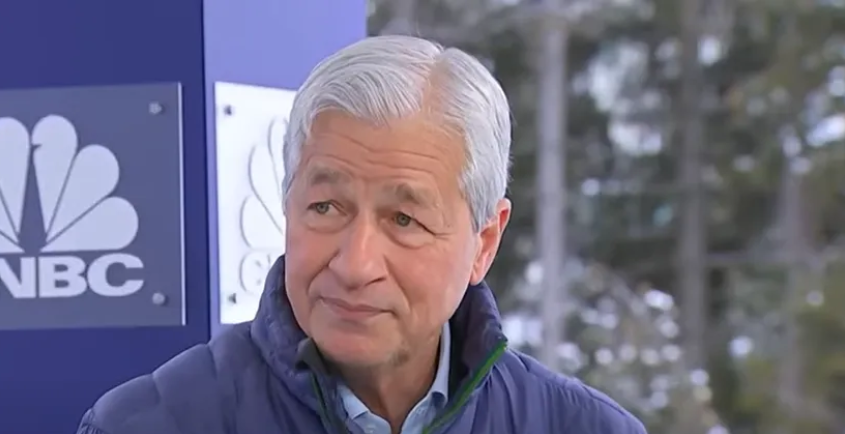

Source — Jamie Dimon YouTube

Jamie Dimon is a force to be reckoned with in finance.

He commands respect as the head honcho of JP Morgan, one of the planet’s biggest and most powerful banks.

It’s not just his position that commands respect. It’s the man himself. He’s someone who knows how to make a deal, how to make a profit and how to make enemies.

Dimon is known for his exceptional intelligence and business acumen. He graduated from Harvard Business School with honours and has spent decades climbing the banking industry ranks, honing his skills and building a reputation as one of the field’s most talented and capable leaders.

He’s known for his ability to think strategically and make difficult decisions quickly, which has helped him navigate the financial world’s complex and ever-changing landscape.

In a recent interview, Jamie Dimon said that Bitcoin is a “hyped-up fraud” and a “pet rock” and thinks it will eventually go to zero.

Even when challenged in the interview, he doubled down on his stance that there is no value in buying Bitcoin.

Dimon says he doesn’t understand the value of Bitcoin and believes it has no actual value. He acknowledges that the blockchain technology behind it is valid and that his company has a similar ledger system.

But he thinks governments will eventually crack down on it and that it’s not an actual currency because it’s not backed by anything of value.

In the interview, Dimon, CEO of JPMorgan, was asked about his thoughts on Bitcoin and challenged about competitors like Blackrock investing in the infrastructure of Bitcoin.

He clarified his perspective.

Jamies Dimon — Source

“Bitcoin itself is a hyped-up fraud, the pet rock of the 21st century.

It’s a waste of time, and why you guys waste any breath asking me (About Bitcoin) is beyond me.

Investing in infrastructure that’s different.

Blockchain is a technology Ledger system that we use to move information.

We’ve used it to do overnight intraday repo. We use it to transfer money directly, so that’s ledger technology.

How do you know it’s going to stop at 21 million? Because I’ve mentioned this to people, everyone says that, well, maybe it’s going to get to 21 million, then Satoshi’s picture will come up and laugh at you after he starts taking out Billions of dollars.”

JP Morgan Is Dabbling With Bitcoin

Despite Dimon’s opposing views, JP Morgan has a history of investing in cryptocurrency.

In the past, the bank allowed private clients to purchase Bitcoin and other cryptocurrencies from a selected number of funds.

JP Morgan built a small position in the US-based exchange Coinbase by June last year. By December 2021, JP Morgan had slightly decreased its Coinbase holdings, and by June 2022, the company had sold all its Coinbase shares but retained some Coinbase bonds.

Even though the bank’s investment in Coinbase is relatively tiny compared to its overall assets, it still shows they’re not entirely opposed to cryptocurrency.

Jamie Dimon — Source

“I personally think Bitcoin is worthless.

I don’t want to be a spokesperson for Bitcoin; I don’t care.

It makes no difference to me.

It’s like smoking cigarettes. Our clients are adults, and they disagree. That’s why they’re smart clients.

So, if they want to have access to Bitcoin, we can’t custody it, but we can give them as legitimate and clean access as possible.”

Final Thoughts

You’ll often hear folks say that traditional finance people dislike Bitcoin because it challenges their traditional understanding of finance and economics.

I beg to differ. It’s the other way around. The digital asset space constantly looks for validation from these kingpins.

It’s true.

Who are we to argue with or challenge a man’s point of view who

A. Is worth $1.6 Billion

and….

B. He doesn’t care about Bitcoin

And why would he?

It’s not like Jamie Dimon is trying to escape the matrix by working his way out of his 9–5. At this point, the only organisation stopping him is the government.

If you’re a Bitcoin investor, you’re happy to take it from him calling Bitcoin a pet rock and a 21 first century fraud. It’d be better if he didn’t. But at least he’s got the success behind him to warrant firing shots.

I don’t even think he’s firing shots. In every interview, he’s always questioned about Bitcoin mainly because his answers divide opinions and create more headlines.

You might have noticed that people interested in Cryptocurrency want acceptance from the traditional finance world.

Not everyone.

But a cohort of people wants banks and other financial institutions to recognise Bitcoin as a valuable asset and legitimate currency.

It comes across as an attempt to encourage more people to use Bitcoin, like one of these shameless influencers shilling a coin to increase its value.

The traditional finance world right now doesn’t give sh*t, so that validation isn’t coming anytime soon.

Deep down, and with all of the uncertainty, people still feel Bitcoin is a high risk, and most see it as a giant safety signal when an all-time financier gives it the Royal Seal of approval.

Well, Jamie Dimon didn’t.

Just like some people choose to smoke and others don’t.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.