Source — Anthony Pomp Twitter

Eventually, people will trust an algorithm for their monetary policy more than any other human.

Anthony Pompliano epitomises the term ‘go-getter.’

He’s a former helicopter pilot for the U.S. Army.

He once spent a month living on the streets to experience what it was like to be homeless.

And he ran a marathon on a whim without prior training or proper running shoes.

He’s a lunatic.

Three weeks into his role at Snapchat, Pompliano got fired for leaking information to the press. He alleged that Snapchat was exaggerating its growth metrics to pump up its IPO. And the CEO, Evan Spiegel, was dismissive when he raised concerns about Snapchat’s sluggish growth overseas.

After losing his job at Snapchat, Pomp became a Facebook product manager. At the time, he was interested in alternative investments and looking for new opportunities to diversify his portfolio. One of his friends introduced him to Bitcoin and explained how it worked.

The rest is history.

Anthony Pompliano is now a Bitcoin maxi who says Bitcoin is the trade of this generation, but you still have to apply timeless investing principles.

Hold onto your hats. Let’s hit the ground running and get into it.

People Will Trust Bitcoin’s Algorithm More Than Money Controlled by Other People.

Pomp says some people are worried about the risks of traditional banking and the value of their money going down.

They see Bitcoin as a solution because banks don’t control it, and it can help protect against those risks. Even though most people don’t necessarily invest a lot in Bitcoin, many put a small amount in it as a backup plan in case something goes wrong with traditional banking.

Or so he says.

Anthony Pompliano—Source

“Eventually, people will trust an algorithm for their monetary policy more than any other human.

Some people look to hedge against currency debasement and the risks associated with the banking system, and Bitcoin can provide a solution.

While not everyone invests a significant portion of their net worth in Bitcoin, many individuals allocate a small percentage, typically between one to five per cent, to act as an insurance policy against potential disruptions in the legacy system.

Over 150 million people worldwide have adopted this system, which is astonishing, considering it has only been around for 15 years.”

You Still Have To Apply Timeless Investing Principles.

Pomp thinks those who hold onto Bitcoin for the long haul will come out on top, similar to people who invested in the right stocks during the Internet age.

One of the most important investing principles is a long-term outlook. Investing is a marathon, not a sprint, and focusing on long-term goals rather than short-term fluctuations is essential.

Anthony Pompliano — Source

“People often discuss week-to-week or month-to-month performance, but Bitcoin is a unique asset that requires long-term thinking.

Despite its significant volatility, with prices fluctuating and experiencing drawdowns of 50 to 75 per cent, those who come out ahead by holding onto the asset follow timeless investing principles.

They dollar-cost average into assets and hold it for an extended period.

Bitcoin is the trade of this generation, similar to how winners and losers were determined by who invested in internet stocks twenty years ago.

By following these principles and not getting caught up in day-to-day volatility, those who hold onto Bitcoin for the long haul tend to come out on top.”

Avoid Sporadic Investing and Day Trading. Your Emotions Will Thank You for It.

No matter how brief, you would have heard the term Dollar-cost averaging (DCA) if you’ve been in Cryptocurrency.

Dollar-cost averaging is a strategy Pompliano suggests where you invest a fixed amount of money at regular intervals, regardless of the price. It can reduce the impact of volatility and lead to more consistent returns over the long term.

It’s what Pomp is saying you should consider, given how volatile Bitcoin is as an asset.

It may surprise you, but data shows that DCA doesn’t necessarily give you a better return than a single lump sum payment (on average) but works better in other ways.

- Reduces your risk with smaller transactions.

- It allows you to buy when the price is lower.

- It helps you ride out market downturns.

- It gives you a disciplined savings tool.

- Prevents bad timing.

- DCA helps you manage your emotional investing

The underlying advantage of DCA is it can help you buy more assets when the market is down.

Use traditional stocks or equities, for example.

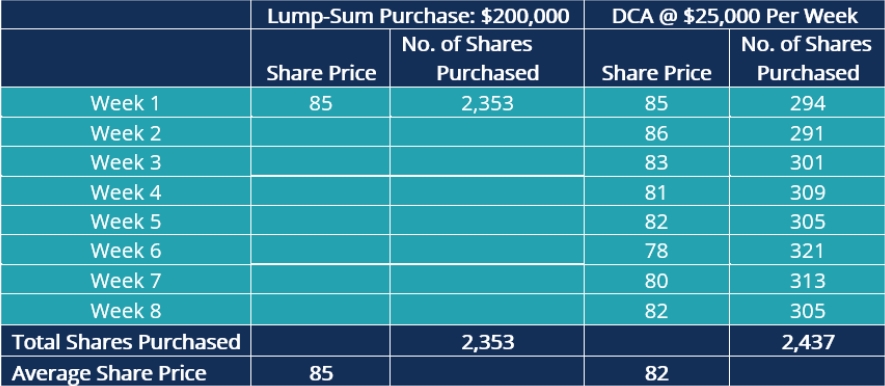

These are wild numbers, but if you have $200,000 to invest, you could use dollar-cost averaging by investing $25,000 weekly for eight weeks.

If you compare this DCA approach to investing a lump sum, you’ll see that DCA can result in buying more shares if the price is in a downward trend.

In the below chart, for a lump sum of $200,000, you could buy 2,353 shares. But with DCA, you’d buy 2,437. 84 more shares worth $6,888 (at an average share price of $82).

Leave Your Emotions at the Door and Have a Long-Term Time Horizon.

Anthony Pompliano is right when he says you can’t look at Bitcoin in a short-term window and react to market fluctuations weekly or monthly.

A long-term view of things is practical and helps you keep your emotions in check from the market’s day-to-day volatility.

One of the primary reasons investors underperform is a tendency to engage in short-term trading, which can lead to higher transaction costs and lower overall returns.

Selling low and buying high is a pattern we all fall into because of our emotions and instincts of loss aversion.

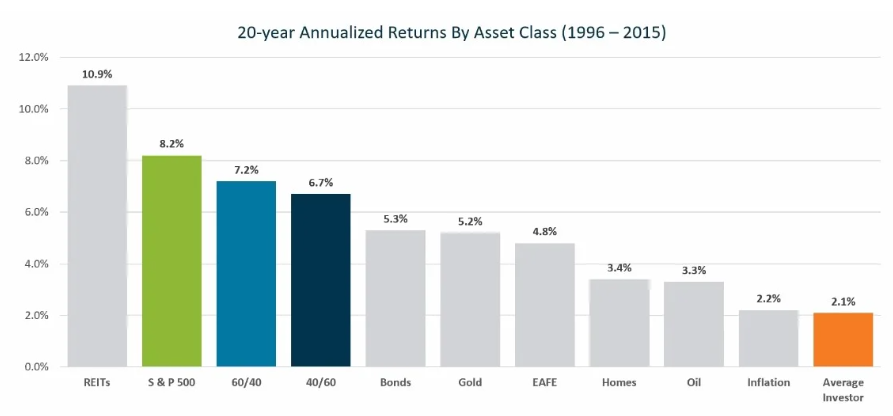

OneDigital collected data on the average return for 20 years ending in 2015, which was 8.2% for the S&P 500, while the average investor who bought, sold and reacted to market fluctuations only earned 2.1%.

For context, inflation during the same period was 2.2%, so your average investor wasn’t even outperforming inflation. They were losing money.

It’s shown on the orange bar in the chart below.

Final Thoughts

As of the end of 2022, people who have owned Bitcoin for more than six months make up 71% of all the Bitcoin available to buy and sell.

That 71% of Bitcoin has yet to be bought, sold or traded in 6 months.

According to the research from Ark Invest (Cathie Wood’s Company), when people have Bitcoin they’ve not traded for around six months, the chance of it ever being sold drops significantly.

More time holding Bitcoin means you’re less likely to sell it, meaning less supply. Chuck in a sprinkle of high demand, and you have Vindaloo that could nuke the lid off anything.

If you look past the Bitcoin Maxi in Anthony Pompliano, you see a guy who knows his stuff.

When he says Bitcoin is the trade of this generation, he’s right. It’s the first time ordinary people like you and I have been able to invest in something without needing to be accredited investors. We can experience all of the potential upsides (and downsides).

While most novices make mistakes, applying timeless principles is critical.

Think over a long-term time horizon.

Remove your emotions

And enjoy the ride.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.