Photo By TechCrunch Free Wikimedia Image

Chamath Palihapitiya: “I’m a Warren Buffett disciple, but he’s wrong about Bitcoin.”

Chamath Palihapitiya is a self-made Billionaire.

The ex-Facebook executive and Bitcoin bull says he grew up in a dysfunctional household.

It had a considerable effect on his character.

He has publicly discussed the emotional and physical mistreatment he suffered as a child inflicted by his father.

As a child growing up, Chamath had a tree outside his apartment. His father would send him outside to collect a branch, which he’d then use to hit Chamath.

If the branch he collected were too small, his dad would send him back to find another.

It led to his hypervigilance. He’d always be on edge, estimating his father’s anger and calculating the strength of the branches he’d be hit with.

In a microcosm of his troubled upbringing, any moment not filled with fear and violence was an experience that left a positive lasting impression in Chamath’s memory. Like when a teacher took him and two other kids to Dairy Queen in grade five, and he tasted his first hamburger, fries, and coconut blizzard.

Chamath’s experience growing up in a state of high alert and moments of kindness from others deeply impacted his sense of value and worth.

The constant psychological abuse made him feel worthless, and as he grew older, he sought external validation through academic achievements and professional success.

Today he has an estimated net worth of $1.2 Billion.

You may recognise Chamath Palihapitiya as an early employee at Facebook who played a critical role in helping the company grow.

He created Facebook’s viral growth strategy, which helped to increase the social media giant’s user base from 50 million to over 700 million during his tenure.

Chamath later challenged Mark Zuckerberg’s leadership and questioned the company’s moral compass. He believed Facebook was more interested in making money than connecting people and improving the world.

Media outlets often feature the early-stage Bitcoin investor because of his well-thought-out critique of the traditional finance system and his lack of fear in calling out some of the most significant investors of all time, including Warren Buffett.

Buckle up, and let’s get into it.

It Would Be Wise To Protect Yourself From Value Destruction.

Chamath thinks if you’re the investing type, you should invest at least 1% of your assets in Bitcoin as insurance against governments and other forms of value destruction.

If you live in a country where leaders make decisions that could negatively affect you and your family, you need this type of insurance.

Bitcoin is a way to protect your assets because governments or institutions can’t control it.

Chamath has expressed further confidence in the long-term prospects of Bitcoin, predicting its price will eventually rise to $200,000

Chamath Palihapitiya — Source

“In 2012 and 2013, when Bitcoin was at $200, and everybody was laughing at me on CNBC every time I would talk about it, I said it’s probably going to a $100k, then $150k, then $200k.

In what period, I don’t know, five years, ten years. But it’s going there.

And the reason is that every time you see all of this stuff happening, it just reminds you that our leaders are not as trustworthy and reliable as they used to be.

So just in case we need some insurance, we can keep under the pillow that gives us access to an uncorrelated hedge.”

The Best Investor of All Time Says Bitcoin Is a Gambling Token.

Warren Buffet is known for erring caution and sticking to investing in businesses he understands using the now-famous value investing philosophy he learned from his mentor Benjamin Graham.

Value investing is a strategy used to find undervalued stocks. You buy when the stock price is below the company’s worth. Investors who use value investing search for companies with solid financials, stable earnings, and good management.

Buffett’s investing thesis centres on finding undervalued companies with a substantial competitive advantage and holding onto them long-term.

He famously avoids investing in technology companies and prefers stable, predictable businesses in consumer goods, finance, and energy industries where he can see they produce output.

The polar opposite of Bitcoin.

Buffett refers to Bitcoin as a “gambling token” but doesn’t fault people for wanting to “spin the roulette wheel.”

Warren Buffett — Source

“Bitcoin has no unique value at all.

It doesn’t produce anything. You can stare at it all day, and no little Bitcoins come out or anything like that. It’s a delusion.

The asset itself is creating nothing.

I think that it’s a gambling device. There’s been a lot of fraud connected with it. There have been disappearances, so there’s a lot lost on it.

Bitcoin hasn’t produced anything. It doesn’t do anything. It just sits there. It’s like a seashell or something, which is not an investment to me.”

Not Everybody Is Right All the Time. We All Have Biases.

I get why Buffett doesn’t like Bitcoin. Heck, he thinks it’s a giant Ponzi scheme. And there’s a good reason. Bitcoin and other Cryptocurrencies are speculative in nature and, in part, move in price based on global liquidity or online sentiment.

It’s why when interest rates and inflation increase, the market prices this in and the market cap of digital assets usually plummets.

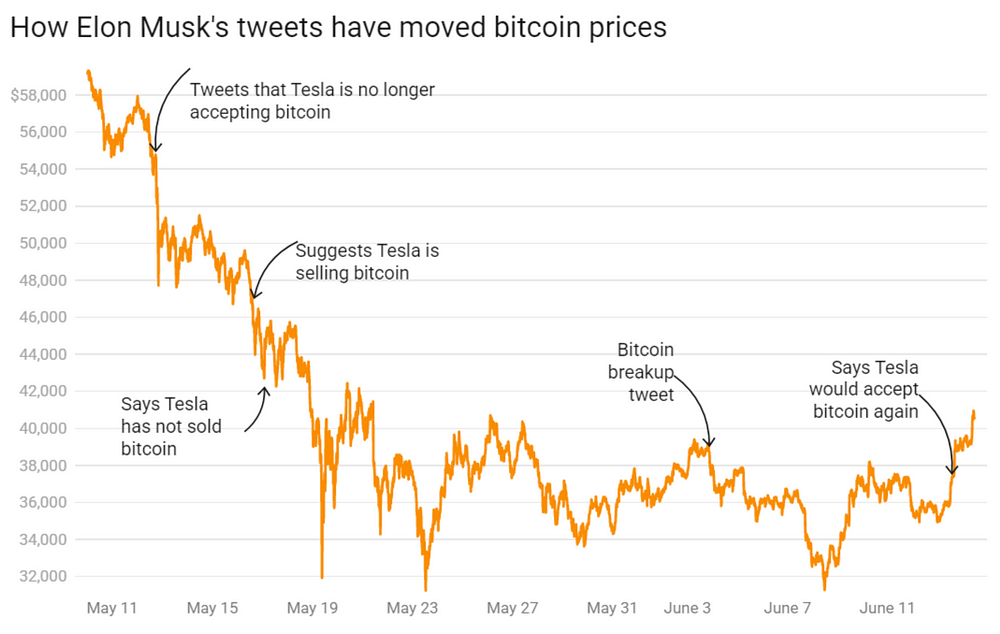

People also hang off influential businessmen and investors (Namely Elon Musk’s tweets) like crack addicts waiting for a dopamine hit.

The data around online sentiment against Bitcoin price action tell a story. When Elon Musk added the Bitcoin hashtag to his Twitter bio, Bitcoin prices increased sharply, rising from $32,000 to $38,000 within hours.

Here’s how Bitcoin reacted each time Elon Musk Tweeted about the digital currency.

Define Your Circle of Competence. And Stay Within It.

Throughout Buffett’s investing career, it’s been evident technology is not within his circle of competence, as evidenced by the fact the only technology companies he invested in are Apple and Amazon.

But even when he made those investments as the best-in-class performer, he entered the game late.

When asked why he didn’t invest in technology stocks, Buffett famously replied that he didn’t invest in companies he didn’t understand. He now admits that might’ve been a mistake.

Chamath is now saying Warren Buffett is wrong again. This time, it’s Bitcoin. And his comments are profound.

Chamath Palihapitiya — Source

“Not everybody is right all the time, and I think we have to acknowledge that we all have biases.

Look, I’m a disciple of Buffett and Munger, and one of the things they have said for years, which I believe, is: ‘Define a circle of competence and stay within it.’

I think it’s been clear in his entire investing career that technology is not in his circle of competence, so the only technology name he’s owned is Apple.

My portfolio is 99% risk on and 1% risk off, and in that 1% risk off bucket, something like Bitcoin is really important.

Why?

Because it’s not correlated to the rest of the market, I’ve been in the Bitcoin universe since 2012. I feel like I need a passport to go through different universes.

Most people who have held since 2012 view it as a hedge against the current financial infrastructure.

Everything (Stock Market) is correlated. We saw that in 2007, but things we thought were a hedge went away. It’s important not to forget what happened there.

If we go through the same events in the future, we’ll see the same correlation, so again, why would it not make sense to have a non-correlated hedge?

This is about buying insurance for a small amount of your portfolio.

Warren Buffett, and others like him, are exceptional.

At what they do!

It’s fair to say that in 30 or 40 years, if I’m a vibrant, successful investor, the idea that I know what’s happening in the market more than some other new entrant is just not true.

The reality is things change.”

Final Thoughts.

I like Warren Buffet — his principles are timeless.

Heck, you don’t become one of the wealthiest men in the world and the most significant investor because you’re clueless.

But he’s wrong about Bitcoin.

Chamath’s views on Bitcoin as an uncorrelated hedge to the traditional financial system are fascinating. People think Bitcoin correlates to the stock market, but it works in lockstep with liquidity cycles. In other words, how much money people have for speculative spending.

There are two points Buffett never mentions or misses entirely or maybe he knows but doesn’t say it publicly.

Bitcoin solves a store of value issue globally, which is a big deal for people in countries with corrupt governments that lack property rights.

And the most important proof of concept which shows Bitcoin is valuable is Metcalfe’s Law.

It’s a concept in telecommunications and network theory that says the value of a network is proportional to the square of the number of its users. In other words, the more people use a network, the more valuable it is.

More and more people are using Bicton at a rate outpacing internet adoption.

Our experience as humans with technology is becoming more digitally immersive, and it makes more sense, not less, that we’ll value digital assets.

If, as an estimate, the digital asset space accounts for about 0.5% of the global money supply. You’re either betting it’ll go down, stay the same or increase.

It’s my bet and the bet of others that the 0.5 percentage increases.

It’s the only thing that makes sense.

And, at the very least, it’s your insurance policy.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.