Photo By JD Lasico on Flikr

You’ll have the most upside if you get in at the ground level before anyone else.

Tim Draper bleeds venture capital.

He typically invests in start-ups with high growth potential but carries significant risk.

Born into a family of successful investors, Draper inherited a talent to identify promising companies and emerging trends.

It’s a skill now ingrained in his DNA.

He anticipates the tech industry’s future and invests in innovative start-ups before they make it big, and his success rate is beyond belief.

One start-up you’d have heard of was an internet calling and messaging service that has since become one of the world’s most widely used communication platforms.

Draper saw the potential of the technology and was impressed by the founders’ vision, Niklas Zennstrom and Janus Friis. So he invested $8.5 million, which at the time was a significant amount of money for a start-up.

Heck, it’s a significant amount of money today.

His investment turned out to be a Major Success because the company revolutionised how people communicate with each other over the Internet.

In 2005, just one year after Draper’s investment, eBay acquired Skype for $2.6 billion, giving Draper and his investment firm a significant return.

Skype was still a relatively unknown start-up, with many investors sceptical of its potential to disrupt the telecommunications industry.

Not Draper.

His ability to see beyond short-term thinking and embrace unconventional opportunities has resulted in a treasure trove of winning investments.

He deployed capital in household names at a time when you’d be scratching your head wondering how they’d feature in our daily lives.

- Skype

- Tesla

- SpaceX

- SolarCity

- Ring

- Twitch

- DocuSign

- Coinbase

- Robinhood

- Hotmail

Hotmail, which most of us use, famously credits Tim Draper as the inventor of “viral marketing.”

The acclaim was from an idea he gave the founders to automatically attach an advertising message to the bottom of each outgoing Hotmail email.

After taking a chance on funding Hotmail — Draper suggested that the founders send a message to people on the web with the words “PS I love you” to attract more users.

The Hotmail team thought he was crazy.

Tim Draper — Source

“When we funded Hotmail, they told me they had a web-based email running. I thought we could send a message to all those people on the web saying, ‘PS I love you. Get your free email at Hotmail’.

They looked at me like I was crazy.

But I kept pushing, and finally, they agreed to add a small message at the bottom of every email saying, ‘Get your free email at Hotmail’.

This was the beginning of viral marketing, spreading to 11 million users in 18 months.

However, I still believe this world would be more loving and peaceful if they kept the ‘PS I love you’.”

If You Understand the Technology Curve, You Will Get In on the Ground Floor Before Anyone Else.

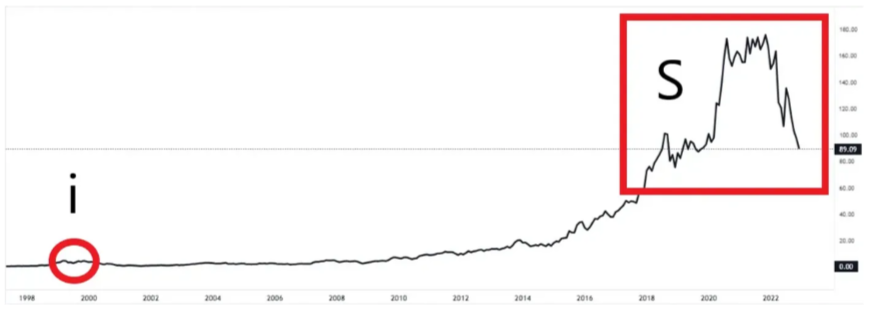

The I and S technology curve describes how new technologies develop, are adopted, and mature.

It’s named after the shape of the Curve on a chart, which resembles the letters “I” and “S”.

In the beginning, new technology is in the “innovation” phase, represented by the vertical line of the “I” Curve. It’s a period of experimentation and development where entrepreneurs and researchers work to create something new and exciting. The technology has yet to be widely adopted or understood during this phase, and progress can be slow.

Once the technology reaches a certain level of maturity, it enters the “adoption” phase, represented by the horizontal line of the “S” curve.

The technology gains traction in the market during this phase, and adoption rates accelerate. It’s often the most significant growth period as technology gains widespread acceptance and changes how people live and work.

Understanding the I and S technology curve can help investors identify which companies and technologies will likely succeed in the long term.

By investing in companies in the early stages of the “I” phase, investors can potentially get in on the ground floor of new technology and benefit from its growth over time.

On the other hand, by investing in companies in the “S” phase, investors can benefit from the rapid growth and adoption of a technology that has already proven successful.

Tim Draper says the I and S curve on a chart makes it easier to see the potential in new technologies that might have a false start at the beginning.

You know, the part when everyone thinks it’s a fad because you’ve seen the first wave of adoption.

- Cars would never replace horses.

- The internet is just a passing phase.

- Only rich people will use mobile phones.

- Why buy something online when you can’t feel and touch it?

Well, Tim Draper’s trick is knowing this, and he says it’s like you’re getting a head start.

Buckle up, and let’s get into it.

You’ll Be the Second Mouse Who Gets the Cheese.

According to Tim Draper, understanding cycles is crucial before investing in any new technology.

Emerging technologies often start with hype while it still needs to be fully developed.

While people focus on the price, engineers are working on developing the technology, particularly during Bear markets.

Draper says the ‘i’ represents the first speculative price increase, while the ‘s’ is the skyrocketing growth as the technology develops.

Amazon is a prime example of this phenomenon, with its market cap rising from around $100 million during its first bull run to over $1 trillion today.

The ‘i’ is no tiny blip despite being invisible on the Amazon price chart below.

The famous dot com bubble Amazon survived is in red below, and it’s hardly noticeable on the chart.

You Need To Get In Before the “S.”

According to Draper, the S curve always peaks higher than the initial ‘i’ stage.

He uses the same example of Amazon reaching a market value of around $100 million during its first speculative pump.

Amazon has reached a valuation of over a trillion dollars, 800–1000 times higher than the ‘i’ stage.

Draper believes this illustrates how people underestimate the potential of new technologies to reach enormous heights, but it’s your opportunity to get in after the “i” and before “s”.

Tim Draper — Source

“I’ll give you an example.

Almost every technology goes through the “I”- “S” Curve.”

The same thing is happening with Bitcoin.

Every industry comes up and gets hyped to the max, and then that is the dot on the ‘i’, then it drops down, and people say the technology doesn’t work, all these things the technology promised it couldn’t do.

So for years, the price sits there languishing.

But while it sits there, all these great engineers are working hard to develop great ways for us to experience the new technology.

The price then starts slowly creeping up like an S, then it explodes for years and flattens out until new technologies come along and go through their same Curve.”

Final Thoughts

The Technology curve provides a practical conceptual framework for understanding the lifecycle of technologies.

It’s not based on specific data points or metrics.

And it doesn’t say which technology you should invest in.

Tim Draper’s point about people needing to understand how big technology can get is spot on. You’re underestimating engineers dedicating their lives to improving the technology, which always leads to a resurgence in popularity and another period of rapid growth before levelling off as new advancements emerge.

As a kid, I had difficulty accepting the concept of purchasing items online without physically touching and feeling them first.

Now you see a high street apocalypse and e-commerce dominating online sales, and Tim Draper says you should have your investor hat on in the gap between the two phases.

You might just get in at the ground level.

Before anyone else.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.