Dave Ramsay, at 26, was bankrupt.

With banks demanding their loans back at short notice, he saw his net worth of $1 million vanish before his eyes.

It proved to be his turning point.

And it led him to become one of the most well-known and respected voices in personal finance.

With a net worth of $200 Million, Ramsay says he’s helped over 10 million people manage their debt.

Simple pleasures are the things that make life worth living for Ramsay.

He’s a car enthusiast.

A family man.

An avid Coffee drinker.

And a dog lover.

The evangelical Christian describes himself as culturally conservative with his finances and passionately hates credit cards for obvious reasons.

His motto is to get people to budget, beat debt, save and invest. His approach to investing is that slow and steady wins the race.

The more boring the investment, the better. It’s like music to Ramsay’s ears when he hears an utterly dull investment opportunity.

Once you’ve paid off your debts and you have an emergency fund covering 3–6 months of living expenses, he suggests you invest in well-diversified, tax-advantaged investments with a solid track record of performance.

Index Funds.

Mutual Funds.

401(K).

IRA.

Ramsey strongly opposes investing in cryptocurrencies. While he doesn’t care what you do with your money, he believes that relying on crypto for financial stability is not wise. Investing in crypto can be risky and may not provide financial stability.

He acknowledges that some people may see short-term gains in the cryptocurrency market. Still, he believes these gains are ultimately unsustainable and that a long-term investment strategy built on sound principles is the best way to achieve financial success.

Ramsay says there are better ways of becoming a millionaire and is adamant the American dream of making yourself a millionaire is alive.

In his eyes, it doesn’t involve investing in Cryptocurrency, and most people who become millionaires do it through consistent investing, avoiding debt like the plague, and smart spending.

No lottery tickets.

No inheritances.

No six-figure incomes.

No Cryptocurrency.

Dave Ramsey warns you against investing in cryptocurrencies because of their extreme volatility and risk. He says people are making financial decisions out of fear.

Fear of missing out.

And fear that their investments are going down in price or being outperformed in the short term.

Ramsay says it ends up like gambling with your money. Some have made short-term profits in cryptocurrencies, but the risks outweigh the potential rewards, and people having some early wins is giving you false confidence.

He doesn’t have a single investment in cryptocurrencies, but he’s worth an eye-watering $200 million.

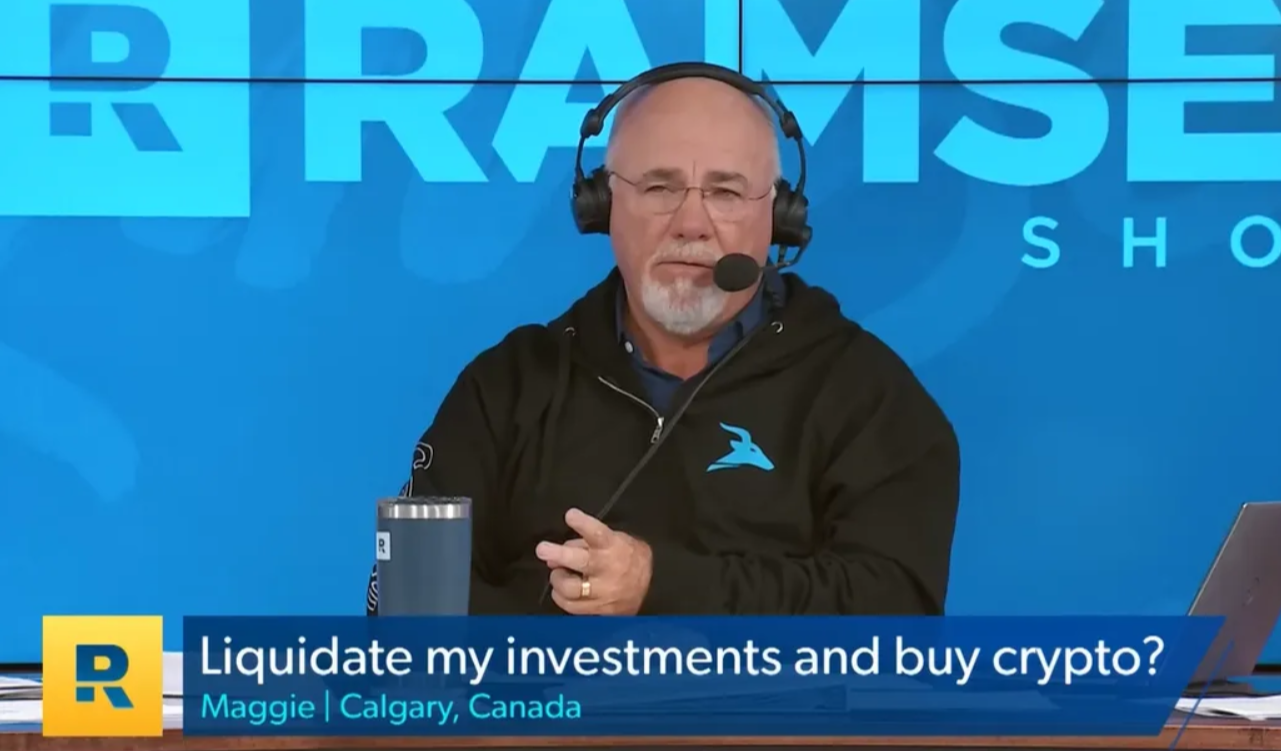

On his radio show, a 72-year-old caller, Maggie, phoned in and asked, to the amazement of Ramsay, if she should put all of her retirement money into Cryptocurrency. His immediate response was to ask if she even watched his show.

The kamikaze caller wasn’t joking around either. She wanted to put all her money into cryptocurrency trading with a “trusted” trader because her investments had declined. And she didn’t see a way for them to return anytime soon.

Ramsey speaking from experience, rightly pointed out to Maggie that she should be careful not to make mistakes that could result in losing everything she owned.

Dave Ramsay — Source

“Let’s back up for a second.

If you’re scared because your good investments went down, you need to be careful.

When people get desperate and scared, they make really stupid financial mistakes.

Desperate and greedy people make the worst financial mistakes.

Your fear is making you do something that is statistically equivalent to putting money on a roulette wheel or a hand of poker.

Crypto is extremely volatile and risky, at least 100 times riskier than your current retirement portfolio, at least.”

Maggie responds that she made $10,000 with a crypto trader and is currently up on her investment, which is far better than what her current assets are doing.

Dave Ramsay — Source

“You’re telling me, ‘Oh, I put money in the slot machine, and I came out with more money than I put in. Well, Maggie, you do what you want. I’m 62. My net worth is hundreds of millions of dollars, and I have zero in Crypto.

I’m not desperate, and I’m not scared. The idea that you have a trader doing it for you scares me even more because this gives you false confidence.

Hey, you’ve had some wins. You have someone whispering in your ear how wonderful they are and how they are going to take care of you,’ which is how people that are 72 years old lose everything they own.

This is how it happens.

Please don’t do this.”

Final Thoughts.

It’s difficult to definitively declare anyone the “best” personal finance expert on the planet.

Dave Ramsay is undoubtedly one of the most well-known and influential voices. His approach to personal finance is grounded in common sense and practical advice.

Some even say outdated.

He emphasises the importance of living within your means, avoiding debt, and building wealth through long-term, steady investments.

None of those investments involves Cryptocurrencies.

And, He’s right.

While I disagree with him on every topic that involves Bitcoin, his common sense approach here is correct.

His cautionary advice is a strong reminder that fear and desperation can cloud your judgment and lead you to make reckless financial decisions.

I’m very bullish on Bitcoin and Cryptocurrency, but I’m not when you need money for retirement, food, or everyday living.

You’ll (should) always hear crypto experts say to use the money you can afford to lose. Not because it’s responsible but because It messes with your head if you need that money for living expenses. Crypto’s volatility is too much to handle.

If you hear anyone say any different. Run. A. Mile.

You might think Maggie’s call is an extreme example of someone naïve, but it’s an insight into how people operate with Crypto. Goldrush mentality and greed take over from clear thinking, and you make unwise decisions.

Or, as Ramsay puts it, “Stupid financial mistakes”.

When markets correct by 70%, people sell out of fear, and some lose entire savings pots.

Writing this would be worthwhile if this helps one person be more thoughtful about buying cryptocurrency.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.