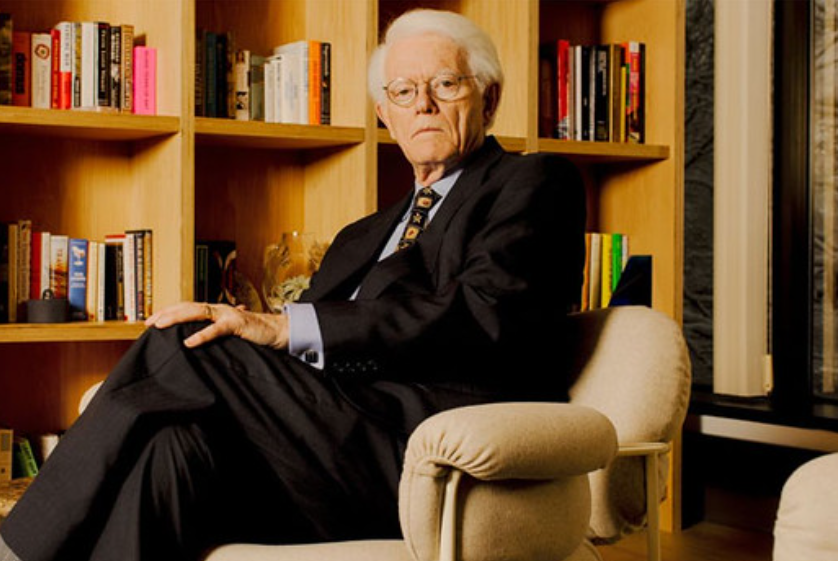

Photo By Heather Sten on Flikr

People will do research buying a dishwasher but will put $10,000 into a stock they heard of on a bus.

Peter Lynch is a famous investor with a primary investment principle.

“Invest in what you know”.

By this, he means that if you’re knowledgeable in a particular area, it’s easier to identify good undervalued stocks in that field. Pretty neat.

Lynch says individual investors are potentially better at making money from stocks than fund managers because they have a unique advantage of spotting the best investments going about their everyday lives that Wall Street may overlook.

He encourages you to look for investment opportunities in things you already know and use, like your favourite coffee shop.

In his book One Up, Lynch shares how he invested in Dunkin’ Donuts after being impressed by their coffee as a customer, not by reading about the company in The Wall Street Journal.

He noticed the Boston locations were always busy with customers and assumed others would be busy too. After studying the company’s financial status, he decided to invest in Dunkin’ Donuts, which turned out to be one of the best-performing stocks he ever bought.

Peter Lynch believes that you, as an individual investor, can also make intelligent investing choices by noticing opportunities like Dunkin’ Donuts or paying attention to business trends in your career or hobbies.

Peter Lynch — Source

“People have natural advantages.

Let’s say what you do for a living is you’re involved in the restaurant industry. You supply paper products. You provide kitchen equipment. You help build restaurants.

You saw McDonald’s, ChiChi’s, Chili’s, Cracker Barrel, Dunkin Donuts, Kentucky Fried Chicken, and Taco Bell.

All these companies have increased 40 to 50-fold. You made 40 or 50 times your money. You don’t need to make that kind of money many times in your life.

That’s all you had to do was follow the restaurant industry. People are in different sectors: the publishing industry, the chemical industry, and the paper. When they invest, why don’t they stay within that industry?

You only need a few stocks a decade. How many good stocks do you need in a lifetime?

Instead, people in the restaurant industry are buying biotechnology stocks, and those in the chemical industry are buying oil stocks.

It’s absurd.”

When You’re Not Good at Something, You Don’t Bother Trying. With Stocks, People Take the Gamble Anyway.

During his career, Peter Lynch was a fantastic investor who made people who put faith in him a lot of money.

From 1977 to 1990, he generated an average return of 29.2% yearly for those who invested in his fund. That’s pretty impressive, considering it was more than double what the S&P 500 stock market index returned during the same period.

While it’s unrealistic to expect to match Lynch’s performance, you can improve your stock-picking abilities using his common-sense strategy.

His insightful views help you pick great stocks that could be from small or predictable companies ignored by professional investors.

You still need to research and factor in financial performance, but using your instinct and sticking to your strength when choosing the right company is essential.

Peter Lynch — Source

“People don’t understand their natural advantages, and they don’t use them.

So that’s terrible number one, but worse number two, if you don’t think you’re a good ice skater or are convinced you’re not a good cellist, you won’t try it.

But people are buying stocks anyway. They’re not discouraged; they just think it’s a gamble.

They bet on one stock for a week and a half, and it goes up, and they make two dollars on it, then sell it and buy something else.

When three years are over, all they’ve done is generate a lot of commissions.

They’ve probably lost money. That’s a mistake. If you don’t understand a company and can’t explain it to a 10-year-old in two minutes or less, don’t own it because you won’t understand what’s happening when the stock goes down.

If it goes down, what do you do? Do you buy more? Do you flip it? Chances are, your broker doesn’t know either.”

Buy What You Know

Lynch is an advocate of buying what you know. And if you don’t have an industry you have a firm understanding of, the next thing is to buy stocks from businesses locally that you’re a customer of and are demonstrating performance.

He says you could have made 50 times your money on Walmart stock if you bought it ten years after it went public. That’s when the company was 25 years old.

He encourages you to research and understand the companies you’re investing in. You have to notice the industries in your town, do some research and an investment like Walmart would have been obvious.

Peter Lynch — Source

“Ten years after Walmart went public, it’s a 25-year-old company. You could have bought the stock and made 50 times your money on it, 50 times.

If you bought it ten years after it was public, it had already gone up five-fold, so you could have made a further 50-fold.

Let’s say you were in a town Walmart came into it, and you thought, ‘Boy, these prices are great, they’re doing terrific, and I like the bargains.’ You checked it out. You spent a little bit of work on it.

People are cautious when they buy a dishwasher. They do research. But they’ll put $10,000 in some stock they hear about on a bus.

If you did some research and saw Walmart’s only in 10% of the country, they’re not even saturated there. Your next thought is, why can’t they go to the rest of the country?

Stock Market Returns Since 2003 (20 Years)

One potential argument against Peter Lynch’s investing thesis is it relies heavily on the ability to identify and invest in overlooked companies that have the potential for massive growth.

Suppose you’re the average Joe who isn’t keen on taking a single bet on a stock or backing your judgement. It would be best if you had more than the queues in your local coffee shop to want to invest.

If you invested $10,000 in the S&P 500 at the beginning of 2003, you would have about $68,396.72 at the end of 2023, assuming you reinvested all dividends. This is a return on investment of 583.97%, or 10.05% per year.

This lump-sum investment beats inflation during this period for an inflation-adjusted return of about 316.95% cumulatively, or 7.37% per year.

If you used dollar-cost averaging (monthly) instead of a lump-sum investment, you’d have $58,144.65.

Here’s an S&P500 chart representing your returns in dollars. You can compare this to investing in Walmart during the same period, which would have grown by 97%, effectively only giving you a return of just less than $20,000

Final Thoughts.

I like Peter Lynch’s practical wisdom when it comes to investing.

Stick to what you know.

If it’s an industry you understand or a hobby, go deeper, do some research and invest in that because if anything goes wrong, you’ll know why.

Theodore R. Johnson, who worked for UPS and never made more than $14,000 a year, is the most famous example.

After a 28-year career, he retired in 1952 with $700,000 in UPS stock. He remained retired for 39 years while amassing a fortune of $70 million. He never invested in anything else.

But this story is famous because they’re few are far between. Heck, with every investment, you may be wrong, even if you’re an expert.

Sometimes, the most straightforward approach is the best. While it can be tempting to try and pick individual stocks, the data suggests passively holding an index fund can often produce better results in the long run.

Unless you think America is disappearing overnight, you’re usually suited to this type of low-risk investment.

It’s like buying a slice of America.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.