Source — Flikr Cathie Wood

Writers have asked me how I come up with these headlines.

Well, here it is.

I read what you say in the comments about people I write about, and I reverse-engineer the words.

I take all that feedback and turn it into something that grabs your attention. I look at the words and phrases people use in the comments and use them in the headline.

Like — “How can you take this woman seriously.”

It makes it feel like the headline speaks directly to the readers who left those comments.

And who doesn’t love feeling like they’re being spoken to directly?

I’ve written about Cathie Wood several times, and the backlash in the comments section has been polarising.

It’s come chiefly from the opposite sex who question her credibility.

And question why Wood should even have an opinion.

Numbers in investing never lie, and at the moment, they’re shocking across the board.

Technology stocks with male founders are getting hammered, and the wild west crypto markets are also getting nuked.

It’s ugly.

And, It’s got me thinking. Is there a gender bias towards Wood, or is she as shite as people say she is?

I like her.

She sticks her neck out in an industry that loathes making predictions because it inevitably comes back to bite you on the arse (UK accent for ass).

When people hear Wood speak, they slip into a dopamine trance, absorbing her price prediction buzzwords.

“Bitcoin to $1 Million.”

“Tesla to $4600.”

“Coinbase is a buy.”

All her recent predictions had been wrong, and the unforgiving internet was happy to tell her.

Fasten your seatbelt, and let’s dive into why you should or shouldn’t ignore Cathie Wood.

Is Wood’s Advice Any Good?

Despite adversity from criticism and market downturns, Cathie Wood continues to push forward with her investment strategy.

She’s the founder and CEO of Ark Investment Management, one of the most well-known names in the investment industry.

She founded her company in 2014 and quickly gained worldwide popularity for her bold predictions.

In 2020, Bloomberg named Woods the best stock picker, with her flagship fund, the Ark Innovation ETF, returning over 200% to investors between March and December 2020.

2022 painted a different picture for Woods and her company.

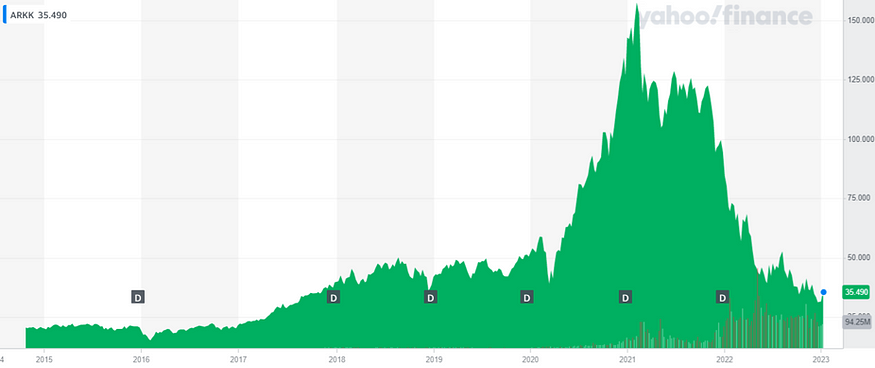

The performance of Ark Invest ETF is in the below chart.

It’s currently down by 78% and has dropped from $157 to $35 a share.

Many investors, attracted by her bold predictions and high-risk, high-reward approach, have seen significant losses as the fund’s value has dropped.

She’s received criticism and negative headlines, with some questioning the validity of her investment strategy and her ability to predict market trends accurately.

No one can predict the future, and the market is correcting, with almost every investment dropping in value.

Before the recent correction, Woods said investing in index funds was a “misallocation of capital”, and you would’ve been far better adopting her Thematic investing style.

She says you would’ve taken advantage of the 400 times return on Tesla stock if you did.

Cathie Woods — Source

“In my view, history will deem the accelerated shift toward passive funds during the last 20 years as a massive misallocation of capital.

Passive funds prevented many investors from enjoying a 400-fold appreciation in $TSLA from a $1.6 billion market cap at its IPO in June 2010 to ~$650 billion when it entered the S&P 500 ten years later in December 2020.”

To see if this idea is accurate, we can look at the S&P 500. It’s a list of the biggest 500 companies in America.

Even though the S&P 500 has only gone down around 15% to 20% in the recent correction, if you invested in it since 2010, you would have only made four times your original investment.

But, if you invested in Tesla’s stock, as Wood suggests, you would have made 120 times your original investment since they first went public in 2010. (taking the correction into account)

Source — S&P 500 — Trading View

It’s worth noting that Wood has been around the investment industry for a long time, spending 18 years at Jennison Associates in New York, followed by a three-year stint at a co-funded hedge fund called Tupelo Capital Services.

So she’s seen at least one or two other significant corrections like this.

Woods has career-long experience in investment management. Mainly as a Thematic Investor.

Thematic investing is a strategy where investors focus on companies involved in specific themes or trends, such as technology, environment, or social change.

The idea is that by investing in leading companies in these areas, the investor can benefit from the growth of those themes in the future. For example, if an investor believes that renewable energy will become more critical in the future, they might invest in companies that produce solar panels or wind turbines.

It differs from traditional investing, where investors focus on a company’s financial performance and market conditions.

When it comes to thematic investing, it’s important to remember that it’s like a football game where the final score settles at the end.

Making a judgement on Woods’ performance at halftime is questionable.

Just because a company or a trend is doing well or even worse in the short term doesn’t necessarily mean it will succeed or fail.

Final Thoughts.

Final Thoughts.

Cathie Wood often makes a rod for her own back, making bold predictions with timelines.

You should never do that.

You should sit on the fence.

Be vague.

And never put your neck on the line.

This is the undertone of what I hear when people call out financial commentators when they predict something wrong.

Wood tries to set herself apart by giving detailed and meaningful insights, but there are people out there who hang off her every word.

They follow financially literate people online and base their investments on what these people say.

It’s why Elon Musk can move markets with a single tweet.

Most people neo use their own judgement with investing and be patient enough to see this all play out before making a call on Wood’s ability.

Wood could be vague and not make predictions to avoid unnecessarily putting pressure on herself.

Heck, that would be boring.

Her Thematic strategy is volatile and even controversial to traditional investors because the companies operating in these areas are young and have yet to establish a consistent track record of growth.

Very few of her investments may work out, but if some meet expectations, it’ll compensate for those that don’t.

And it’ll be because she’s a world-class performer.

Not because she’s a woman.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.