Photo by Tarik Haiga on Unsplash

It’s easier to summarise someone’s background and credibility as a financial analyst when people know who they are.

PlanB is an anonymous but well-known figure in the world of Bitcoin and cryptocurrency, and his detailed analysis has gained him 1.8 million followers.

His name cleverly represents the B in Bitcoin but has a double meaning referring to the alternative to the current monetary system.

He’s an institutional Investor who studies charts with over 20 years of experience in financial markets.

In March 2019, PlanB created the Bitcoin Stock-to-Flow (S2F) model. This prediction model uses the relationship between the existing supply of Bitcoin and the rate at which miners create new Bitcoin to estimate future prices.

People in the crypto community consider the S2F model to be one of the most accurate ways to predict the future price of Bitcoin.

The idea behind it is Bitcoin’s scarcity drives its value. So, we can predict the future price potential by measuring Bitcoins scarcity.

The S2F model looks at the number of currently available Bitcoins (circulating supply) compared to the number of new Bitcoins mined each year and gives you a fair value and a prediction of where Bitcoin should be.

The chart below displays the price of Bitcoin in dollars, represented by the rainbow line.

The line running parallel to it represents the fair value prediction of the model, which is where it predicts the price of Bitcoin will go. There may be some deviation between the two lines, but they generally remain close together.

The zig-zag line at the bottom of the chart shows the deviation between the actual price of Bitcoin and the fair value prediction according to the Stock to Flow model. The green indicates that the model suggests Bitcoin is currently under-priced based on its fair value prediction.

Every four years, through a “halving” process, the number of new Bitcoins mined is cut in half. It plays a significant role in determining Bitcoin’s value according to the S2F model.

Miners receive 6.25 bitcoins (BTC) for each block they successfully mine, becoming 3.125 Bitcoins around March 2024.

PlanB’s predictions have been gaining a lot of attention recently, particularly his prediction that the price of Bitcoin will reach $100,000 by the end of 2025, as you can see on the chart above.

And he’s also now saying, contrary to popular belief, this recent rally is here to stay because it’s a clear Bitcoin Bull cycle.

According to his analysis, he believes that Bitcoin reached a ‘bottom’ in November 2022 at $15,500, and the price will continue to rise in the lead-up to the 2024 halving event, which he predicts will result in a price greater than $32,000.

Predicting Price Charts Based on Historical Data Is Gambling (Warren Buffett)

Warren Buffett is a legend in the investing game. He’s known for his ability to spot winning investments which have grown his net worth to $107 Billion.

If you’ve spent any time watching his videos, you’ll know he dislikes Bitcoin and thinks the type of technical analysis Plan B produces is gambling.

Not that he would know who PlanB is, considering his comments about Bitcoin being like “rat poison squared.”

Buffet’s points on studying charts are essential. And I agree with his stance that predicting the future is challenging based on a live chart and historical information.

People view charts or technical analysis differently and say things like, “if we carry on, on the same trajectory, we’ll end up at X”, or “according to the last correction, if we have something similar, we’ll end up at Y.”

That sounds like a whole lot of who shot John.

Warren Buffet shares his clear stance on studying charts. He prefers not to use technical analysis to predict the future of an asset, but you should make up your mind if you agree.

Buffett is all about using fundamental analysis when evaluating a company. He says looking at a company’s financials, like revenue, earnings, and assets is the best way to determine its value.

Bitcoin doesn’t have this because there’s no central party creating productivity. It’s a decentralised store of value.

Buffet says, “Charts are great for predicting the past.” However, they are unreliable and don’t indicate what will happen in the future.

Warren Buffett — Source

“As a kid, I started investing and became very interested in technical analysis and charts of stocks, all kinds of crazy things and studied (charts) for hours and hours.

I saved money to buy other stocks and tried shorting, and I just did everything, and then when I was either 19 or 20, I can’t remember exactly.

I picked up a book someplace. It wasn’t a textbook at school but in Lincoln, Nebraska.

I looked at this book and saw one paragraph that told me I’ve been doing everything wrong. I just had the whole approach wrong.

After seeing a chart illustrating the concept of ambiguous illusions, I realised this approach was foolish and changed my strategy.”

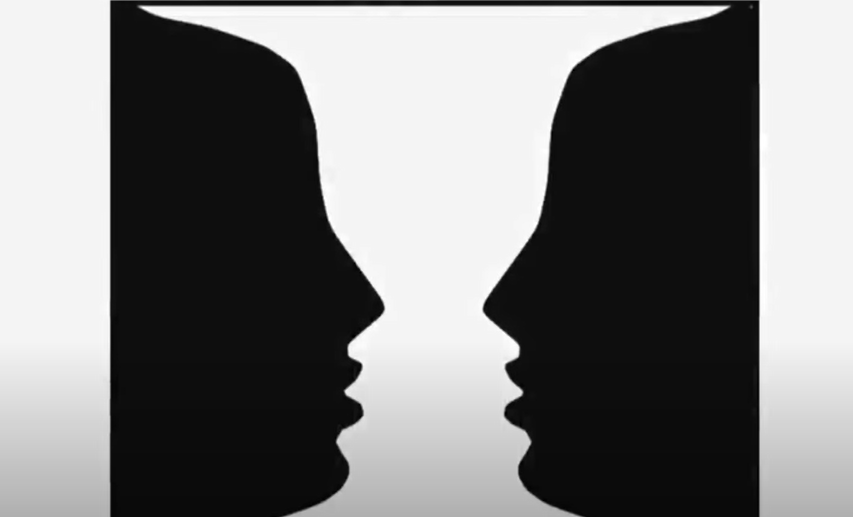

Buffett compares his mindset to investing in a similar way. We see pictures that reflect an ambiguous illusion.

When his thoughts began settling, he realised it was a complete illusion. He realised he was looking at this investing game wrong, which deceived him.

It led him to change his approach to investing.

He says it’s a bit like how you look at this picture.

What do you see?

A Duck or a Rabbit?

Buffett says in the following picture that some people will look for a long time and see two faces, and some people will see a vase, but the mind flips from one side to the other, which is the ambiguous illusion you face as an investor.

Buffet says that people who predict things (E.g. PlanB) will garner attention because giving certainty to people appeals to our human spirit.

Warren Buffett — Source

“In terms of the predictions, there’s a market out there all the time, and people love to hear predictions.

We would have a million people here if I offered many predictions today.

They’re dying to have predictions and speeches at Rotary clubs and trade associations.

That’s what our whole industry is built upon: the people coming out of Washington that talk about predictions.”

Buffet says he wandered around with technical analysis looking at charts until he read The Intelligent Investor, which changed his life. He says he doesn’t know where he’d be with his investing thesis if he hadn’t read that book.

Warren Buffett — Source

“The Intelligent Investor by Benjamin Graham changed my life on investing.

I started investing when I was 11, and for about eight years, I wandered around with technical analysis and doing all kinds of things.

When I read the book, I was 19, which changed my approach.

The book told me I wasn’t looking at the duck. I was looking at the rabbit, which changed my life.

If I hadn’t read that book, I don’t know how long I would have gone on looking for Head and Shoulders formations and 200-day moving averages on a chart.”

Final Thoughts.

People all over the internet will come up with theories and dates of when things will happen because it appeals to our human instincts to find certainty in uncertain things.

Bitcoins value is in its network effects. No one can anticipate a timeline for this.

PlanB is incredibly good at what he does. He’s garnered such a massive following by making bold predictions that, to me, have nothing to do with future demand.

Many factors will cause Bitcoin’s price to go up and down, like record inflation, increased interest rates, a high consumer price index report, and a looming recession, maybe even the worst we’ve seen in 100 years.

My point is that you can’t predict this stuff because too many variables are at play, including government regulation.

PlanB’s stock-to-flow model and technical analysis go off the idea that patterns and trends repeat themselves without considering outside influence.

He’s even suggested that the next two years could make or break the model.

You should decide whether you think we’re in a bull market or if it’s a bull trap for Bitcoin.

I would love to hear what you think in the comments.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.