Photo by Malte Helmhold on Unsplash

I know everyone compares every new technology to the Internet.

It’s getting dull.

But the Bitcoin comparison sticks out like a diamond in the pile of coal.

It’s natural to view the past with a sense of acceptance and be like, “eh, that’s how things were”, but when it comes to thinking about the future and new technology, we tend to be all, “meh, that probably won’t work out” instead of seeing the potential for it to change our lives for the better.

And let’s be honest. Technology doesn’t care if we pay attention to it or not. It’s utterly unemotional and will continue to consume our attention.

The things we’re debating today will become routine and mundane in the next decade.

Before the mass adoption of the Internet, people said some incredibly short-sighted things.

Similar to the current views on Bitcoin.

Robert Metcalfe, a computer scientist and entrepreneur, is most famous for inventing Ethernet, which you probably use daily without even knowing. Prominent investor Raoul Pal, who I write about often, refers to Metcalfe’s law, which is, you guessed it, a reference to Robert Metcalfe.

In 95, Metcalfe wrote an article for International World Wide Web Conference where he predicted that the Internet would “catastrophically collapse.”

He thought the internet was getting too crowded with traffic, and it was too harsh a task to train the world to use it, so it would soon become unusable.

Metcalfe promised to eat his words if the Internet didn’t collapse.

So, In 1997, during his keynote speech, he took a printed copy of his column that predicted the collapse of the internet, put it in a blender with some liquid, and then drank it down.

What a guy.

He originally wanted to eat his words printed on a cake, but the audience preferred that he suffer by swallowing the paper.

Clifford Stoll, a journalist for Newsweek, wrote one of the most narrow-minded articles about the Internet, also in 95. There’s a theme here.

To this day, he utterly regrets writing it.

Who could blame him or Metcalfe? People had no idea what the Internet was or how we’d use it.

We knew how the Internet would impact the world, but the cat wasn’t strictly out of the bag, and many people leaned into what they knew, denying the Internet would ever impact our lives.

Stoll’s article dismisses every use case of the Internet — things we accept as a norm today were almost seen as a fantasy not worth believing.

It’s hard not to notice the resemblance between Stoll’s predictions and some people’s negative attitudes towards Bitcoin.

Clifford Stoll — Source

“They speak of electronic town meetings and virtual communities. Commerce and business will shift from offices and malls to networks and modems.

And the freedom of digital networks will make the government more democratic. Baloney. “

“Do our computer pundits lack all common sense?

The truth is that no online database will replace your daily newspaper, no CD-ROM can take the place of a competent teacher, and no computer network will change how the government works”.

While this is only one article and an individual’s point of view in a moment nearly 30 years ago, it perfectly highlights our ongoing cynicism toward new technologies.

Stoll later reflected on his article and backtracked less theatrically than Metcalfe.

Clifford Stoll — Source

“Of my many mistakes, flubs, and howlers, few have been as public as my 1995 howler.”

“At the time, I was trying to speak against the tide of futuristic commentary on how The Internet Will Solve Our Problems.”

Bitcoin Is Outpacing the Internet.

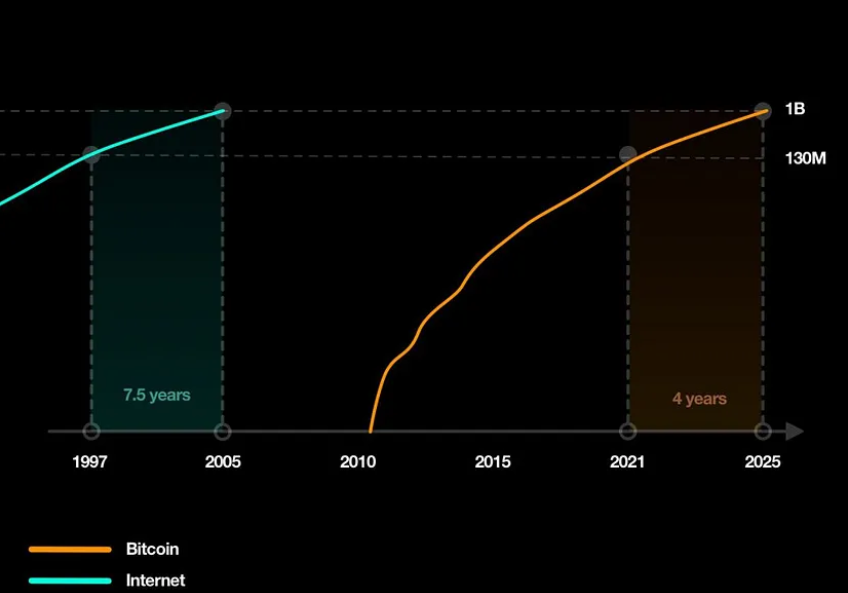

Bitcoin had around the same number of users as the Internet in 1997.

However, the most significant difference is that the Bitcoin adoption rate is much higher than the Internet.

If Bitcoin continues on its same trajectory, it will have around 1 billion users in the next four years.

With crypto users growing at around 80% a year, this makes it the fastest rate of technological adoption in human history.

Here’s a look at the historical adoption curve of Bitcoin vs the Internet in 1997:

Bitcoin Will Become Even More Scarce.

Bitcoin’s halving event occurs every four years when the reward for mining Bitcoin transactions is cut in half.

Even as demand increases, halving reduces the rate new coins are created and lower the available amount of new supply.

These events have always correlated with significant increases and price crashes but have always ended up with higher lows and higher all-time highs after the event.

The next halving event is in 2024 when block rewards for miners will reduce from 6.25 to 3.125 Bitcoin.

Here’s How We Resist New Technologies

In the Book, Innovation and Its Enemies: Why People Resist New Technologies, professor Juma discusses how innovation occurs and why scepticism and confusion are often inevitable.

The Book draws from 600 years of technology history, but here are some insightful takeaways you must know.

- New Technology is constantly under public pressure to stay the same.

- New Technology faces opposition when the general public feels benefits only accrue in the long run.

- People are ok with New technology as long as it doesn’t challenge what we already know and our position in the food chain.

- People resist New Technology when the benefits favour a small group. (Mobile phones were meant to be playthings for Rich People)

If you removed the words “New Technology” from the above and replaced them with “Bitcoin”, you’d have an excellent visual for why people are missing this opportunity.

People insist on resisting change until it becomes our new normal, and we wonder why we ever lived without it.

Bitcoin is taking up the Market share of Gold.

Goldman Sachs recently reported that there is a strong possibility that Bitcoin will continue to take away Gold’s market share as digital assets become more widely adopted.

According to a report by Goldman Sachs, the market capitalisation of gold held as an investment is around $2.6 trillion. In comparison, the value of Bitcoin is $442 billion, meaning Bitcoin currently holds 17% of the market for “store of value” assets.

In its list of predictions, the global investment giant pegs Bitcoin as an asset class “most likely” to become more significant than Gold over time.

Final Thoughts.

If you want to be in the business of predicting the future, you should go to Las Vegas.

But there has to be a part of you that looks at innovation and at least believes that it’s not going away.

Technology, or Bitcoin, isn’t suddenly going to stop dead in its tracks and then decide to turn around and head back to wherever it started.

It’s come way too far.

Granted, we’re in for some choppy waters.

- Governments could Ban Bitcoin.

- They could and most likely will tax Bitcoin heavily.

- You may find they’ve yet to recognise it as a legitimate store of value.

Forget Bitcoin for a moment.

It’s estimated that digital assets make up 0.5% of the global money supply.

Over the next ten years, that 0.5% is either going up or down, maybe even sideways.

- Regulation and government control may make it go down.

- People becoming more digitally native and progressively moving into a more digitally immersive world may increase it.

My view over a long-term time horizon is that the 0.5% digital asset figure vs money supply will increase in value.

For me, you can look at all the charts you like, but that fundamental view is what it boils down to.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.