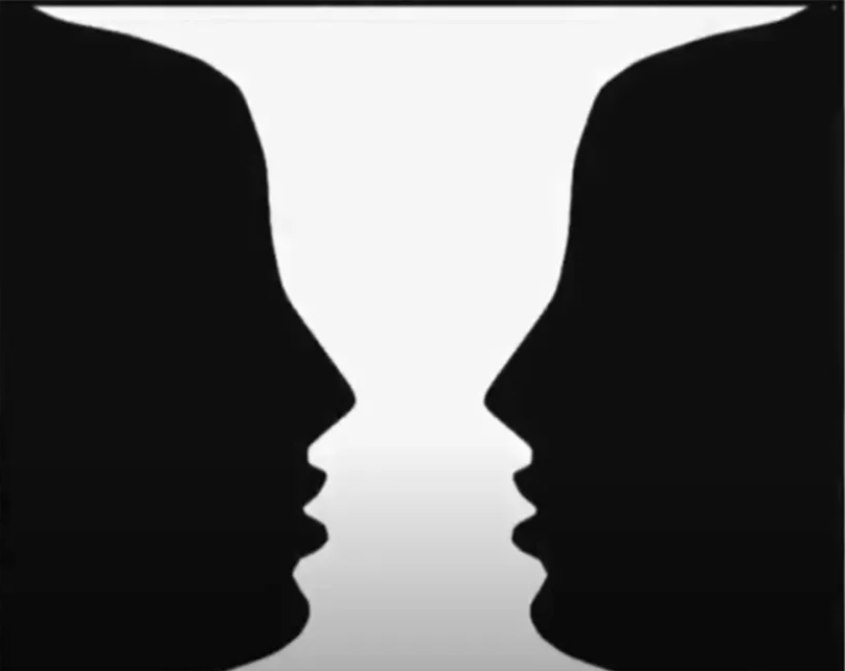

Image Source (What Do You See ? Two Faces or a Vase?)

Warren Buffett’s success is no accident.

He’s a World Class Investor.

He’s wired to detect risks and can see around corners regarding his investments. Buffett simplifies even the most complex topics when you hear him speak.

As a kid, he was freakishly bright and plagued by a persistent curiosity that never seemed to fade. Some of the ventures he tried were beyond his years and entirely out of the ordinary.

Barely a teenager, he launched multiple businesses selling golf balls, magazines, chewing gum and Coca-Cola door-to-door before age 10.

Buffett made his first-ever investment into a company at 11. He bought three shares of stock in a company called Cities Service Preferred for himself and his sister.

Then at 13, he put a down payment on a farm that sold eggs and bred rabbits. Buffett later started a lucrative Pinball machine business, placing these into barbershops.

It was equivalent to lemonade stands but on steroids. Buffett says he started building his investments like a snowball at the top of a long hill.

He says the trick to having a very long hill is either starting young or living to be very old. Seemingly he’s managed both.

By the time he finished college, Buffett had accumulated $9,800, equivalent to $112,000 today.

On his first income tax return in 1944, Buffett took a $35 deduction for using his bicycle and wristwatch for his paper route.

Warren Buffett is a legend in the investing game and known for his ability to spot ‘winners’, which has grown his net worth to $107 Billion, making him the 5th richest person in the world.

He says his strategy for building wealth has sometimes been incorrect, and as a kid, he made many foolish mistakes. He mainly got caught up studying charts and quick trading, which he describes as gambling.

It only dawned on him that he was looking at his investing career completely wrong when he read the book “The Intelligent Investor”.

And he summarises the changes he made by explaining the concept of ambiguous illusions, which helped him realise that his previous approach was foolish.

Warren Buffett — Source

“As a kid, I started investing and became very interested in technical analysis and charts of stocks, all kinds of crazy things and studied (diagrams) for hours and hours.

I saved money to buy other stocks and tried shorting, and I just did everything, and then when I was either 19 or 20, I picked up a book someplace.

It wasn’t a textbook at school but in Lincoln, Nebraska.

I looked at this book and saw one paragraph that told me I’ve been doing everything wrong. I just had the whole approach wrong.

After seeing a chart illustrating the concept of ambiguous illusions, I realised this approach was foolish and changed my strategy.”

Ambiguous Illusion

An ambiguous illusion is a type of mind-bending illusion that plays tricks on your brain. It’s the kind of illusion that can make a picture of a vase look like two faces staring at each other (pictured top of the blog), depending on how you see it.

The illusion can be ambiguous because it’s not always clear what it’s supposed to represent.

Different people might see the image differently, and it can be tough to figure out which interpretation is correct. But that’s what makes ambiguous illusions fascinating. They challenge our brains to see things from different perspectives and interpret visual information in new and unexpected ways.

Warren Buffett explains that ambiguous illusions can be interpreted differently, depending on the viewer’s perspective. He uses the example of the “duck-rabbit” illusion, where some people see a duck while others see a rabbit.

Buffett explains that the mind can sometimes play tricks on us, and it can take a moment of truth or an “aha” moment to see things differently.

For Buffett, the concept of ambiguous illusions was significant because it helped him realise that his approach to investing was wrong. He spent hours studying charts and trying different techniques but looked at things incorrectly.

He thought he was in the business of picking stocks that would go up, but by his admission, he needed to see the bigger picture. When he read a paragraph in “The Intelligent Investor” that illustrated the concept of ambiguous illusions, it was like a light bulb in his head.

Buffett realised he had done everything wrong and needed to change his strategy by looking at things differently. This realisation was a pivotal moment in his life and investing career, and it set him on the path to becoming one of the most successful investors of all time.

His thoughts began settling, and he realised it was a complete illusion. He realised he was looking at this investing game wrong, leading him to change his approach to investing. Reading “The Intelligent Investor” by Benjamin Graham changed his life.

The book showed him that he was looking at the wrong thing in his approach to investing. He thought he was looking at the duck when he was looking at the rabbit.

Warren Buffett — Source

“The Intelligent Investor by Benjamin Graham changed my life on investing.

I started investing when I was 11, and for about eight years, I wandered around with technical analysis and doing all kinds of things.

When I read the book, I was 19, and it changed my approach.

The book told me I wasn’t looking at the duck, I was looking at the rabbit, and it changed my life.

If I hadn’t read that book, I don’t know how long I would have gone on looking for Head and Shoulders formations and 200-day moving averages on a chart.”

Final Thoughts

Warren Buffett has remarkable skill in communication.

His gift for simplifying complicated concepts made him one of the most successful investors of all time, but it’s also made him a beloved figure to many people who watch his interviews.

The concept of ambiguous illusion is not just an interesting topic of discussion but can also have practical implications for your investing strategy.

Warren Buffett points out that we should be aware of our biases and assumptions when analysing what we invest in and push ourselves towards seeing something else if our strategy isn’t working.

By being open-minded and willing to challenge our assumptions, we can avoid falling prey to focusing on the same things that do not bring us results.

This article is for informational purposes only; it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.